Word count: 520. Estimated reading time: 3 minutes.

- Summary:

- The Mintos subprime lending investment portfolio has been significantly altered, with a major change made last month. The previous two-thirds investment in ExpressCredit was completely divested, and the portfolio is now split between Capital Finance and ID Finance. This change was made after ExpressCredit’s rating dropped by 31 points, and political turmoil in Botswana raised concerns.

Sunday 1 September 2019: 22:11.

- Summary:

- The Mintos subprime lending investment portfolio has been significantly altered, with a major change made last month. The previous two-thirds investment in ExpressCredit was completely divested, and the portfolio is now split between Capital Finance and ID Finance. This change was made after ExpressCredit’s rating dropped by 31 points, and political turmoil in Botswana raised concerns.

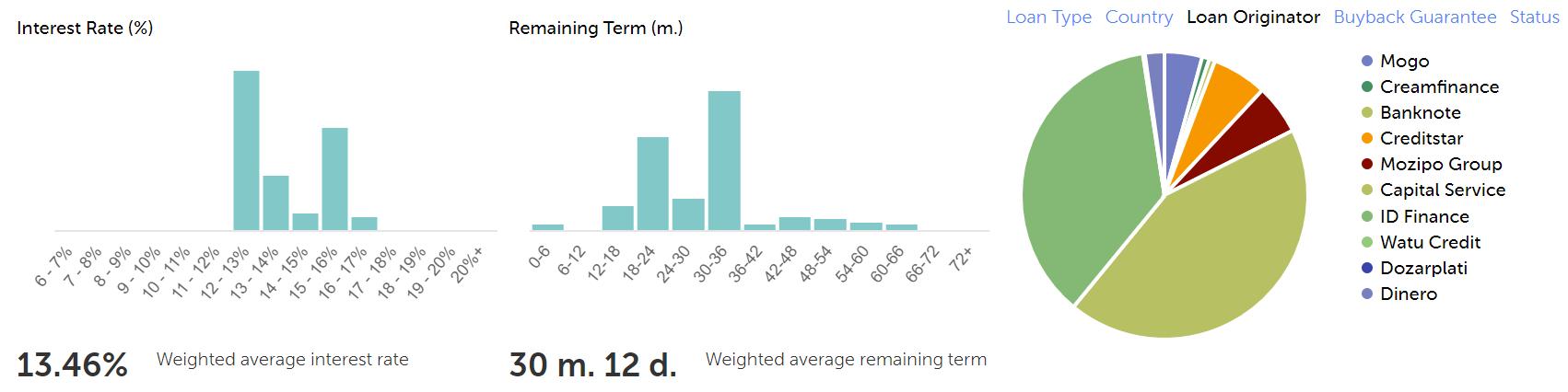

If you remember that in this post, I was two thirds invested in a single loan originator, ExpressCredit, who mainly lend to the Botswanan middle classes. About half way through August I divested from ExpressCredit completely, and now my portfolio is distributed thusly:

I am now split mostly between Capital Finance, a Polish lender, and ID Finance, a Kazakhstani lender.

To divest, I sold all my ExpressCredit loans on the secondary Mintos market at par (i.e. no premium). The bulk of them sold within ten minutes, far faster than I expected – in hindsight, I should have tried asking for a premium for them given their particularly high coupon rate. Because the Mintos auto investment bot has a minimum granularity of €10, interestingly after ten minutes most of my loans had something less than €10 per loan remaining – something to be born in mind when setting diversification actually, perhaps a minimum auto investment bot loan amount of €10 makes it harder to very quickly cash out. Within a day though, human buyers had cleaned me out completely for the small remainders, and I was completely free from ExpressCredit.

Selling out half way through the month meant losing the interest payments for half of the month for two thirds of my investment, so naturally this month took a big hit from preceding months:

| Month | Annualised return for each month |

|---|---|

| June 2019 | 16.24% |

| July 2019 | 16.56% |

| August 2019 | 10.38% |

It’ll recover considerably next month, but another thing which I should have done was to sell loans after they have just paid out. Not mid-month.

So why so spooked about ExpressCredit? Two things. The first was that https://explorep2p.com/mintos-lender-ratings/ dropped their rating like a stone, by 31 points from 53 to 22, and I don’t invest in anything under 30 points. They made a very hefty loss last year after many years of profits, and now have a negative equity balance sheet, which is bad. The second is that there is surprising political turmoil in Botswana just recently, the worst they’ve had in their entire country’s history, there was an article in the Economist about it. So I panicked, and probably lost about €30 of income for not timing and pacing my sale better.

On the other hand, it sure does prove the liquidity of Mintos’ huge market. They have now funnelled €3 billion of investments through themselves, so they have a ton of users. So if you want to cash out quick, you can be free and clear (if you have loans others want to buy) within 24 hours judging from this single experience.

Which is good to know. My cashed out investments were soaked up by others (I told my investment bots to heretoforth exclude ExpressCredit) within a day or two at the highest rate I could find, which is a fair bit lower than what ExpressCredit were paying. So I expect monthly annualised returns to be more of the 13-14% variety moving forwards.

| Go to previous entry | Go to next entry | Go back to the archive index | Go back to the latest entries |