Word count: 2361. Estimated reading time: 12 minutes.

- Summary:

- The third part of this post series describes how I have personally configured my own investments on Mintos, given my extremely conservative preferences to neither cause harm to others, nor to take any risk of losing any money ever. My investments are set up with the Auto Investment bot, which is configured to invest in loans with a minimum interest rate of 15% and a term no less than two months. The bot also excludes loan originators with weak balance sheets or those not rated A-B by Mintos.

Thursday 1 August 2019: 20:32.

- Summary:

- The third part of this post series describes how I have personally configured my own investments on Mintos, given my extremely conservative preferences to neither cause harm to others, nor to take any risk of losing any money ever. My investments are set up with the Auto Investment bot, which is configured to invest in loans with a minimum interest rate of 15% and a term no less than two months. The bot also excludes loan originators with weak balance sheets or those not rated A-B by Mintos.

The first part gave some background and recent history of evolution in debt financial technology, and explained how the stuff which caused the 2009 financial collapse is now available to Joe Soaps like you and me, rather than just to traders inside large financial institutions such as investment banks. This means that the outsize financial risks, and profits, formerly available to a ruling elite are now available to anybody with a spare few grand i.e. you can now directly profit from subprime lending, and directly take the hit when it collapses rather than governments bailing out banks.

The second part described the risks involved with investing specifically with Mintos, specifically (i) Platform risk (ii) Loan originator risk (iii) Moral risk (iv) Maintenance risk (v) Sale risk (vi) Currency risk.

This third part will be on how I have personally configured my own investments on Mintos, given my extremely conservative preferences to neither cause harm to others, nor to take any risk of losing any money ever:

- No investing in payday loan debt. It is morally repugnant (avoid moral risk). See part 2 on what happens to payday borrowers in poor parts of Europe who default on their debt.

- Euro only investment, as I don’t want to take on currency risk.

- Never ever lose money, even if it hurts absolute returns (minimise loan originator risk).

- Aim to only earn inflation on a cash pile sitting in banks (minimise platform risk).

- Keep maintenance risk low by automating as much as possible, as I don’t get much free time nowadays to hover over things.

Indeed, this post is several months late, due to that lack of free time thing just mentioned. Sorry about that, however the upside is that I now have two full months of earnings data which I can report:

| Month | Annualised return for each month |

|---|---|

| May 2019 | 4.49% |

| June 2019 | 16.24% |

| July 2019 | 16.56% |

These are my own calculations incidentally, rather than those supplied by Mintos. The Excel formula, in case you are interested, is pow(pow(thismonth/lastmonth, 1/daysinmonth), 365.25)-1 (i.e. figure out the decompounded daily interest rate, then compound that to a year).

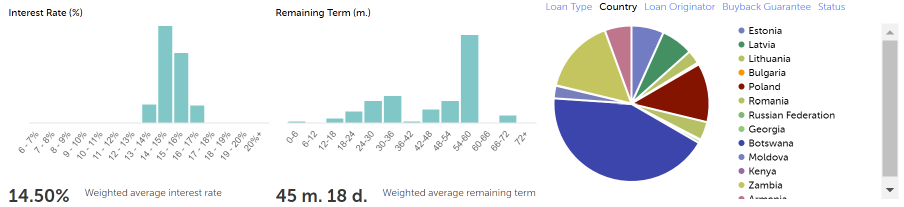

The low return in May was because I was taking investment slowly, as I learned the ropes, but I let the bots invest everything completely by end of month. Thus June and July are rather better, indeed a ~16% annualised return is extremely healthy, considering that my pension gets less than 6% per annum! However, equally, as described in the previous posts, this sort of investment is a lot more brittle than investing in a mutual fund – as the investment can only go upwards, that puts a lot of pressure on the loan originator’s finances if the market ever sours, which means you may lose all your investment with that individual loan originator. Hence diversification of which loan originators you invest in is important.

Speaking of which …

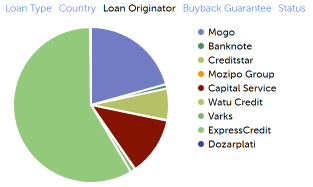

Note the overexposure to a single loan originator, ExpressCredit which is an African loan originator, which was due to a mistake by me which caused the investment bots to go further than I had intended. For similar reasons, most of my investment ended up in Botswana, which is actually not an unhappy accident (Botswana is stable and wealthy for Africa, quite similar to Portugal in absolute terms actually, and it’s their relatively wealthy middle class who have taken my money). This isn’t the end of the world, as capital is paid back monthly with interest, thus one’s investment in any one place naturally shrinks quite quickly. In fact, it was originally three quarters ExpressCredit, and in just two months it’s unwound to 60% already. So, if you make a mistake on Mintos like I did, just fix the investment rules, and be patient and let it unwind naturally.

So how did I set up these investments? As described in previous posts, you must configure the Auto Investment bot with the rules by which it must invest:

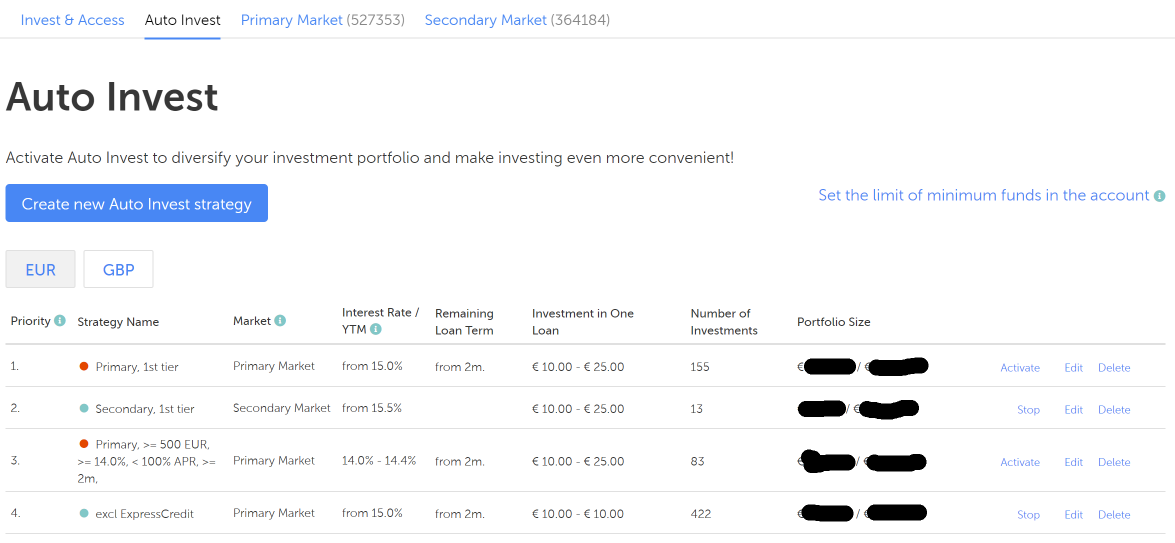

This is the list of auto investment bots that I currently have (note that some are disabled, you can turn a bot on, let it run, turn it off if that suits your requirement). They are in priority order, so bot number 1 is run first, then bot 2, and so on. You will note that bot 4 excludes ExpressCredit, as I am reducing my exposure to them to improve diversification.

Each bot can be given a name, mine are fairly boring. It will be told whether to invest in the primary market (newly issued loans to buy) or the secondary market (other Mintos users selling their loans), and various parameters like minimum interest rate, loan term, minimum and maximum investment per loan, and maximum portfolio size for that investment bot. Be careful to set the maximum portfolio size low when changing anything, else you’ll end up investing three quarters of your money in a single loan originator like I did.

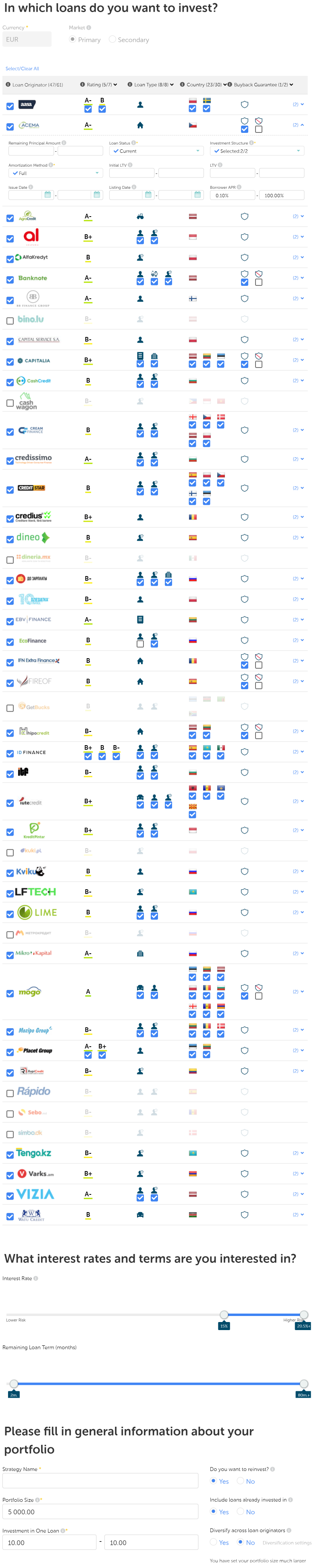

Within the auto investment bot’s editing page, there is a very long list of all the loan originators. You can individually set rules for each, include or exclude them, and so on. Please do not manually create this bot by hand, you can actually create an auto investment bot from a search. So, create the search, screw down tightly all the possible parameters, then create an auto investment bot from that search. Much quicker!

Given how many loan originators there are to choose from, I have made this screenshot scrollable. Scroll it using the right hand scroll bar:

You will notice that quite a few of the loan originators are completely unticked. These are the loan originators scoring at the bottom of http://explorep2p.com/mintos-loan-scanner/ rankings, and I explained it in part 2 of this post series. The current exclusion list, at the time of writing, is Bino, Dineria, EuroOne, Getbucks/Mybucks, Kuki, Kredo, Metrokredit, Peachy, Rapicredit, Rapido, Sebo, Simbo, Tigo. These are all loan originators with weak balance sheets, or are loss making, and thus have a higher chance of bankruptcy and your investments with them getting lost or written down.

Less obvious is that in the column headings, there are more things unticked. I have unticked C and D rating, so loan originators not rated A-B by Mintos are excluded (I don’t hugely trust these, there is a conflict of interest for Mintos rating them, but it’s worth combining an exclusion of these with those from explorep2p above). I didn’t actually untick any countries, but I did untick loans without Buyback Guarantee i.e. the capital will be repaid in full after 60 days if the loan becomes sour.

At the top of the screenshot, I expanded out the settings for one of the loan originators. Firstly, you want to double check that the the white shield is ticked and not the shield with the cross, as that is the Buyback indicator. Secondly, you probably only want the bot to choose current loans i.e. ones not in arrears. Thirdly you want to exclude loans with ‘weird’ repayment structures, like interest-only payments with the capital only repaid at the end (these have an obviously high chance of default right at the end, so you wait around 60 days to get your capital back, which is 60 days not earning), so choose an Amortisation Method of ‘Full’. Finally, to exclude usurious loans, set the maximum borrower APR to 100%, and to exclude payday lenders who claim a 0% borrower APR%, set the minimum to 0.1%.

Some may feel that a 100% borrower APR is very usurious, and by the West’s standards it would be. However, it’s actually a function of the local economy. In Botswana, typical loan APRs to the wealthy middle classes are in the 40-80% range because overheads are so high. Collateral is hard to value and expensive to seize, administration costs are high, and company profitability needs to reflect the risks taken (ExpressCredit is very profitable indeed, incidentally). So in the end, it’s all relative.

Towards the bottom of the screenshot (scroll the image above downwards), I tell the bot to only choose loans paying 15% or more, and with a term no less than two months. The latter is another way of excluding payday lenders, who almost entirely lend for a month or less.

Finally, at the very bottom, there is the all important Portfolio Size. This is the maximum that this particular bot will invest. Set it low to begin with. The Investment in One Loan determines the minimum and maximum investment per loan that the bot will do. You cannot go lower than €10. The maximum determines how diversified your investments across individual loans will be, but setting it too low will slow down how quickly an initial capital sum gets invested, perhaps from hours to weeks if your other investment parameters are too rarefied (and loans paying 15% or more is definitely rarefied). A €10 maximum is probably too low for quick investment with these parameters, €25 more than halves the cash drag (the time investment money remains in cash, and not earning).

Moving over to the option boxes on the right, choosing to reinvest means whether after a monthly payment is received should the bot invest the cash in new loans back up to the portfolio limit, if that is possible according to the rules you set. Usually for most bots you want this to be Yes. Including loans already invested in means that if after a loan instalment the amount invested in an individual loan is below the maximum, it will be topped back up to the maximum, if the rules are met, and more of that loan is available. You probably want Yes for that one as well. Finally, the Diversify across loan originators is a bit of a misnomer, it really means ‘do you want to override the default loan originator diversification algorithm?’ which is to diversify investments according to the average weight of each loan originator’s total loans on Mintos. As the default is a very sensible default, you probably want No to that question.

Auto investment bots for the secondary market

As you may have noticed in the total list of bots above, I have it grab loans at >= 15.5% from the secondary market and at >= 15% from the primary market, on the basis that loans sold by other Mintos investors are more likely to be lemons, even if the bot only invests in non-delinquent loans. When configuring bots for the secondary market, it is very important to set the max premium to 0%. This is because loans can be sold with a premium or discount on the secondary market, and most people naturally try to get a premium first, and if and only if they can’t sell the loan, do they drop the premium. Those in a hurry to cash out obviously charge no premium, or even give a discount.

Why it is so important to configure the bot this way is because loan originators can repurchase the loan from you at any time. When they do, they pay its net value. That means that if you paid a premium, you lose that premium. This repurchase in full happens quite frequently in fact, the loan originator may have found a cheaper source of financing, or the borrower simply repaid early. This is why you must avoid your bot paying premiums on secondary market purchases, it loses you money.

Too complicated? There is a ‘I don’t want to think’ choice …

Finally, if all the above is way too complicated for you, you can just invest your money diversified across all of Mintos equally without having to tick nor configure anything. This is called ‘Invest & Access’. Simply set how much you want to invest, and it’ll distribute it across all the loan originators according to their total weight on the Mintos platform.

One big advantage of choosing this method is instant cash out, no need to bother with manually selling your loans on the secondary market. But be aware that you can only instantly cash out those loans which are not delinquent, so investments via this mechanism are instant cash out only up to the current weighted average delinquency rate on Mintos.

What this means is that ‘Invest & Access’ is particularly prone to whenever p2p subprime lending comes crashing down: you’ll get exactly the average proportion of loan originator defaults on all of Mintos. I cannot guarantee that the manual investment method will be either better or worse of course, but I would like to think that the careful exclusion of the weakest loan originators as according to explorep2p might help.

Finally, a warning!

I don’t want to beat the dead horse much further, but I do want to close this post reminding readers that this is a risky investment. If a mutual fund on the stock market returned 16% per annum during a bull market, it achieves that because it is also able to lose 16% per annum during a bear market.

This variant of p2p lending that I have described has only upside, in normal times. Your money can only rise, or not rise, but never fall. But for this to work, during an economic downturn that means someone, somewhere, must foot the bill for rising bad debt. When their reserves exhaust, they’ll go bankrupt, and thus exhaust the reserves of their creditors, causing more bankruptcies, and so on. That’s what economic downturns do.

So be very careful here. Bankruptcy happens slowly, and then suddenly. Loan originators will look strong, and then suddenly go bang. So long as the ~16% returns will be more than the amount that you will lose when an originator goes bust, stick with Mintos. As soon as you believe that this may no longer be so, time to get out, and remember lots of other Mintos investors will be doing exactly the same i.e. there will be a run on Mintos, people will have to sell their loans with large discounts in order to shift them quickly.

Good luck!

| Go to previous entry | Go to next entry | Go back to the archive index | Go back to the latest entries |