Word count: 3244. Estimated reading time: 16 minutes.

- Summary:

- The platform risk is the main reason I avoided investing any money in peer to peer lending platforms at all until now: I don’t trust the security of 98% of web platforms. They are generally written in a rush by inexperienced, underpaid developers, insufficiently tested, and other people’s money is not given sufficient care of duty.

Thursday 23 May 2019: 21:01.

- Summary:

- The platform risk is the main reason I avoided investing any money in peer to peer lending platforms at all until now: I don’t trust the security of 98% of web platforms. They are generally written in a rush by inexperienced, underpaid developers, insufficiently tested, and other people’s money is not given sufficient care of duty.

As I explained in general terms in the previous post, this sort of investment is brittle. In the longer term, roughly once every twenty to thirty years per region, the entire system collapses and needs to be bailed out by the government. Having already discussed the big picture risk, I wanted to dig into the specific risks of investing specifically on Mintos, which is by far the largest fintech of its kind in Europe, and perhaps will soon be unquestionably also so anywhere in the world given it is growing at ~350% per annum.

My third and fourth posts on this topic will discuss my personal strategy for investing in loans on Mintos, but before that, I’ll try to list all the risks which I personally can see on Mintos, ranked in order.

1. Platform risk

This is the main reason I avoided investing any money in peer to peer lending platforms at all until now: I don’t trust the security of 98% of web platforms. They are generally written in a rush by inexperienced, underpaid developers, insufficiently tested, and other people’s money is not given sufficient care of duty. Very frequently, startups get hacked, money rerouted or stolen, and your money goes missing. Most startups can afford to silently replace stolen monies up to a point, but past a point they go bust, and you lose everything.

And even if there is some competent programming and testing going on, and an arm’s length secure storage of other people’s money is rigorously enforced, then you have big risks in one or all the startup founders running off with your money, secretly competing against investors or tipping the playing field in their favour so you on average lose out, and lots worse still.

For all these reasons, I have avoided this entire area completely for the past two years. And I’d still avoid 99% of the platforms yet for the same reasons.

Mintos have been running now for four years, and were only big enough to get sufficiently noticed by criminal hackers for about two years now. So their web platform is probably reasonably debugged by now. Even then, I absolutely refuse to ever place my money with anywhere, including major banks, without a separate device One Time Pad (OTP) login option, either using a separate physical hardware token, or more often an app on your phone nowadays. Mintos only added 2FA in October 2018, and thus only from then onwards did they become an option for me (and I didn’t have the spare cash from then until now to invest, due to the Verizon contract ending in November 2018).

Mintos are now handling €200 million a month, have 2FA, and so I’ve become just about convinced that the risk is worth it. However, remember that although Latvia is an EU country with strong Scandinavian characteristics, company regulation and enforcement is not on a par with say, Sweden. The Latvian financial regulator has presided over a raft of major financial scandals recently, including widespread money laundering by financial institutions, though it is very important to note that the crimes were done by Latvian branches of Western banks, rather than Latvian banks. The point is that they don’t have the resourcing which say financial regulators in Britain have, nor the influence and weight to cow multinational banks into behaving well, and they certainly have granted unusual leeway to financial innovation compared to anywhere else in the world. In short, I wouldn’t count on strong financial oversight from the Latvian regulator.

2. Loan originator risk

Mintos is a marketplace, and there are currently about sixty firms advertising their loans for purchase on Mintos. Some of those firms are squeaky clean, models of transparency and good governance, with extremely healthy balance sheets. Some others have been loss making for years, provide almost no information at all about their internal operations, and some are possibly even money laundering fronts. Just as with investing in individual company stocks, it’s a wild west out there. You need to do your research before investing your money with a given loan originator.

This is particularly important because of ‘Loan buyback guarantees’. Because retail investors hate to lose money, most of the loans on Mintos come with this guarantee by the loan originator that you will never lose capital, only profit, if an individual loan sours. Most of the loan buyback guarantees (it varies per originator) kick in after 60 days of non-payment of loan installments – you get to keep all the interest payments up to that point, and you get your invested capital back. This dramatically lowers the risk for the retail investor, so long as the loan originator is solvent!

The loan originators, in turn, implement buyback guarantees by reducing a little bit the rate paid on loans with buyback guarantees, and using that pool of money to pay back capital for any loans which default. Some loan originators e.g. car loan giant Mogo offer the same loan on Mintos with and without buyback guarantee, that way you can choose whether you want a higher average rate of APR with more risk, or whether Mogo should take on the risk and keep more profit.

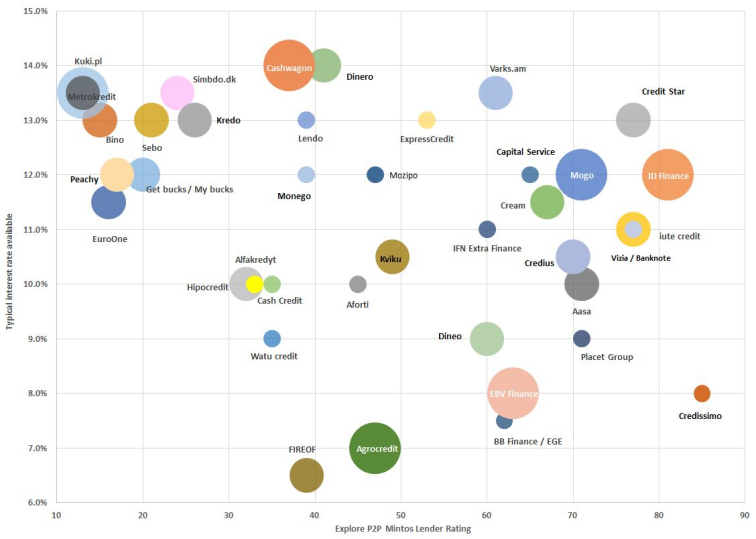

Obviously enough, this makes a buyback guarantee for a loan stretching over years only as good as the loan originator’s finances. However Mintos are really big, so there is an army of people out there doing research, and publishing it to their blogs. The most famous is probably the http://explorep2p.com/mintos-loan-scanner/ ‘bubble chart’ of loan originator riskiness to coupon rate:

Note this is a snapshot of their graph from May 2019. You should visit http://explorep2p.com/mintos-loan-scanner/ for up to date ratings

At the time of writing, ExploreP2P would strongly recommend against buying loans from the left side of the graph, which is Bino, EuroOne, Getbucks/Mybucks, Kuki, Kredo, Metrokredit, Peachy, Sebo, and Simbo, due to a toxic combination of weak balance sheets, lack of transparency, and a history of making losses.

Mintos themselves also give ratings of the loan originators on their platform. You can see their ratings and their loan originators at https://www.mintos.com/en/loan-originators/. You will note that their ratings vary a fair bit from ExploreP2P’s, and I would be personally minded to choose the intersection of the two i.e. only those originators not in the ‘bad list’ of both. Something to be noted is that Mintos gives different ratings to different subgroups of a given loan originator, so for example car loan giant Mogo has no less than nine Mintos ratings, ranging from A to B, which vary depending on which bit of Mogo is doing the loans.

You can of course do your own research! Mintos publishes the audited accounts and lots of links to the loan originators’ legal and financial documentation. You can also search Google for good or damaging news about the loan originators. You can check the loan contracts given to their customers, see if they look exploitative, or have anything weird about them in their fine print. I’ll be honest in saying that I wasn’t bothered enough to do more than a cursory pass for EUR denominated loans (it was was a very different story for GBP denominated loans, that’s in the final part of this post series): I just scratch the ‘bad list’ from both Mintos AND ExploreP2P for the AutoInvest bots, and I reckon that’s probably good enough for a numbers-game based investment strategy.

Finally, it might be worth looking into what happens when a Mintos loan originator goes bankrupt, as has happened once before with Eurocent. When Eurocent stopped honouring the loans, around €180k was outstanding to Mintos investors. Mintos submitted the claims for those investors as part of the Eurocent wind up, and they will eventually get paid back whatever percentage of their investment remains divided by all creditors equally. So, in case of loan originator bankruptcy, you will get back some percentage of your money after however many years it takes to wind up the business.

3. Moral risk

Loaning money to others is often seen as a ‘dirty’ business, but that’s not the kind of moral risk I mean here. More specifically, I mean unsecured, very short term loans (days, no more than a month) for a few hundred euro issued at many hundreds of percent APR. In British and US parlance, these are often called ‘payday loans’, though they are actually any form of very short term, unsecured debt at astronomical interest rates.

These are issued to people with a negative or non-existent financial histories i.e. too poor and marginal to afford loans. Due to their usurious nature, about half the borrowers get into real difficulty, rolling over short term loans repeatedly until eventually it all falls down. In Eastern Europe and Africa, this usually means a debt collector giving you or a family member a beating, or breaking a limb. Or firebombing your house. All this is as old as the ancients, which is why usury was a sin in biblical times, and long before even then.

Mintos, being a marketplace, doesn’t discriminate between all legal forms of loans. It’s up to you to not choose to invest in that sort of debt. Guidance on how to do that on Mintos is sorely lacking on the internet, because short term loans are amongst the most popular with Mintos investors, principally because (a) they pay the highest rates of interest (about 1% (i.e. 7-10% more interest) more than the highest form of non-short-term loans) and (b) people don’t have to bother selling their loans on the secondary market if they need to withdraw their money quickly. Such selfishness comes with an enormous cost in terms of human misery. Such loans often are at 600-700% APR to the borrower, yet the Mintos investor only gets < 20% APR. That gives an indication of just how much overhead goes on enforcement and collection of loans (and marketing and provision of course). And if you drill into the individual loan listings on Mintos, you’ll often see that the individual is on their fourth or sixth short term loan from the same provider. All I can say, is avoid, avoid, avoid.

For the remainder of these series of posts, I am going to assume that you don’t like your money doing evil to others, and my Mintos investment strategies are specifically designed to avoid any investment, whatsoever, in short term exploitative usurious loans. The Mintos blog post above actually tells you how to program the Mintos AutoInvest bots to avoid such loans:

- Avoid loans for less than €500.

- Avoid loans with borrower APR in the hundreds of percent.

- Avoid loans with terms of less than two months.

- Avoid loans with irregular amortisation structures (i.e. choose loans which repay an even portion of the principal monthly or weekly).

Finally, even if you don’t care about poor people and just want maximum returns, consider that a large proportion of unsecured short term borrowers default. As all interest on loans for less than a month is paid at the end of the loan, and assuming the buyback guarantee, that means that you get back your capital without interest. That, in turn, drags down your average return to much lower than the maximum rate.

Therefore, if you actually want to maximise your earnings, invest in loans with a lower rate of default. According to https://www.mintos.com/en/statistics/, at the time of writing perhaps 30% of short term loans do not pay any interest. That reduces a juicy 15% headline interest rate to middling 10.5%, which is below the current Mintos average return to investors of 11.89%. Food for thought!

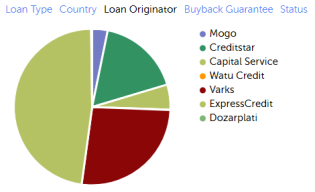

4. Maintenance risk

Maintenance risk goes two ways. The first form is that loans get repaid in installments, which means ~1% of each loan appears as cash in your Mintos account each month, plus loans can be repaid early, and indeed often are for the higher APR loans. If early repayment in full happens, you get your capital and interest up to that point back, added to the cash balance in your Mintos account. That cash is then no longer earning, which is called ‘cash drag’ in the lending jargon. The way around this is to leave an AutoInvest bot always running, so it’ll automatically reinvest early repayments into new loans according to rules set by you. This is fine, however over time the bot may end up over-concentrating your portfolio into just one loan originator, or just one kind of loan, which ruins diversification and thus increases risk. So you do need to check, from time to time, how unbalanced your portfolio is becoming using Mintos’ very good graphing tools, and switch on, or off, different AutoInvest bots to retilt the balance in a new direction over time.

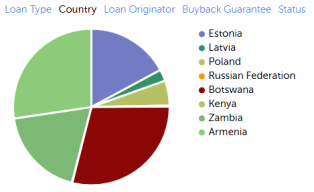

The loan originator and country diversification of my current EUR denominated loans on Mintos. Note how ExpressCredit originate nearly half my entire EUR portfolio, so I have stopped new loans going to them for now. Note also that nearly half my EUR loans are in Africa (that's ExpressCredit again!), with the remainder all in Eastern Europe.

The second form of maintenance risk is less obvious, and harder to address. Interest rates rise, as well as fall. If they fall, if you have invested in longer term loans which I strongly suggest that you do (details are forthcoming in the next two posts in this series, one on EUR loans, the other on GBP loans), then you’re sitting pretty as you’re earning more than the going rate. If however they rise, as they have done for EUR denominated loans on Mintos these past few months, then you may be sitting on loans paying less than what you could be getting. Moreover, your AutoInvest bots, being configured for lower interest rates, may well be purchasing new loans on your behalf paying far below what you could be getting.

Mintos usually send you a newsletter update when average rates increase, so it’s probably worth subscribing to that. And when it happens, you almost certainly want to reconfigure your AutoInvest bots to target the new, higher interest rate. However, be then aware that if average rates then drop, your AutoInvest bots won’t be able to find new loans at the higher rate. That means cash will mount up in your account, not earning, and you are back into ‘cash drag’.

So, all in all, you probably do need to login at least once a month, and do a bit of work checking how things are going, and reconfiguring if needed. And turn on the daily email statement of your account. This isn’t a completely ‘hands off’ form of investment.

5. Sale risk

As I mentioned in the last post, Mintos is huge, with a large and liquid secondary market where you can sell your loans to other investors, and thus quickly recoup your money if you need to exit suddenly. This sets it far apart from most competing fintech startups in the same field, which can take weeks to months to sell your investments to other investors. As great as this liquidity is, there is however a risk that you won’t recoup all of your money, and this is because of average interest rate movements.

If the loans you are selling pay less than new loans, you will have to offer a discount to buyers in order to get them to buy your loans. Often this is 0.5%, I have noticed for loans not in arrears, but it does depend on the spread between what you are selling, and new loans. You might think that a surplus would correspondingly be paid for secondary market loans which pay more than the current average, however a ton of investors won’t touch loans with a surplus, because loans can be repaid at any time, and that is at par i.e. you take a cash loss. That means that for a quick sale, you don’t get what great loans are worth, but you do have to pay for selling inferior loans.

This is one-way pricing pressure of course, and it operates against you cashing out early and retaining all the profit you have accumulated. Chances are good that the cost of sale on the secondary market won’t exceed a month’s interest, except if you’re trying to sell loans in arrears (don’t do that! Wait for the buyback guarantee to activate instead!). Still, this secondary market sale risk is worth mentioning if you expect to need to extract cash from Mintos in a hurry. Equally, if you can afford to take a few weeks, you can just wait for other people’s AutoInvest bots to buy your loans at par value, so you get back their full current worth.

6. Currency risk

Chances are that you, like me, won’t want to deal with currency risk, and so will only be willing to invest in loans denominated in your home currency, which for me is EUR. The problem with currencies is that they fluctuate and move unexpectedly – I should know, as I get paid in US dollars, and I’ve watched my EUR income drop by a few hundred euro per month these past few months. If you expect to keep your money on Mintos in the same loans for years, then I suppose it can make sense to pay for conversion into say, Russian Rubles (0.7% charge), Mexican Pesos (1.25% charge) or whatever they use in Kazakhstan (1.25% charge), and be aware you’ll pay the same charge to return to EUR. Given that the highest paying non-short-term loans in EUR are currently 15.0%, and in Rubles 19.0%, assuming no currency change then it would pay off after six months or so. But if the Ruble drops even by 5%, now you’re down. Equally, of course, it could rise by 5%, and then you’re laughing.

For me personally, currency betting is too risky. I don’t want the chance of losing money. And as you may have noticed from the country pie chart above, EUR denominated loans are not going to EUR denominated borrowers. Rather, the loan originator is taking on the currency risk, offering you a lower APR, so you don’t have the chance of seeing a loss.

Next two posts in this series

My next two posts will be on configuring Mintos AutoInvest for EUR, which is a very liquid currency on Mintos, and on trying to use Mintos for GBP, which right now is painfully illiquid since Mintos got its UK subsiduary licence refused by the UK financial supervisor, which led to all the UK investors fleeing, and UK loan originators yanking all GBP denominated loans (still, with a bit of work, one can still invest a few grand in GBP on Mintos, it’s just rather … manual). See you again soon!

| Go to previous entry | Go to next entry | Go back to the archive index | Go back to the latest entries |