Word count: 1160. Estimated reading time: 6 minutes.

- Summary:

- The concrete ‘lego’ blocks at the back of the western wall are being stacked temporarily on bare unlevelled earth. They need to be removed, the ground levelled and packed crushed rock laid on top as a foundation, and then the blocks laid into their final positions. The weather is not looking great, so it will take three days to complete this task.

Wednesday 2 August 2023: 22:39.

- Summary:

- The concrete ‘lego’ blocks at the back of the western wall are being stacked temporarily on bare unlevelled earth. They need to be removed, the ground levelled and packed crushed rock laid on top as a foundation, and then the blocks laid into their final positions. The weather is not looking great, so it will take three days to complete this task.

These are on bare unlevelled earth, they need to be removed, the ground levelled and packed crushed rock laid on top as a foundation, and then the blocks laid into their final positions. I reckon it’ll take the three days especially as the weather is not looking great. After that, what remains for me and the digger is to wait until after the end of September so I’m legally allowed clear the vegetation behind where my future vegetable garden is, I intend to clear it and lay down permeable membrane to hold down future growth. I then lay the last of those lego concrete blocks, and the rear boundary of the site is ready for the soil spill pile from excavating the foundations of the house.

I do still need to fit under that soil spill pile vermin and damp proof underground storage for potatoes to be covered with soil. I haven’t even figured out how to exactly do that yet unfortunately. I have in my head some sort of buried tank, like a Graf Carat XXL tank but its manhole is only 0.6m wide, which seems annoyingly tight to get sacks of potatoes in and out. I fear a prefabricated underground solution will be a lot more expensive than building an underground room with concrete blocks properly tanked to keep the damp and vermin out. Time consuming though.

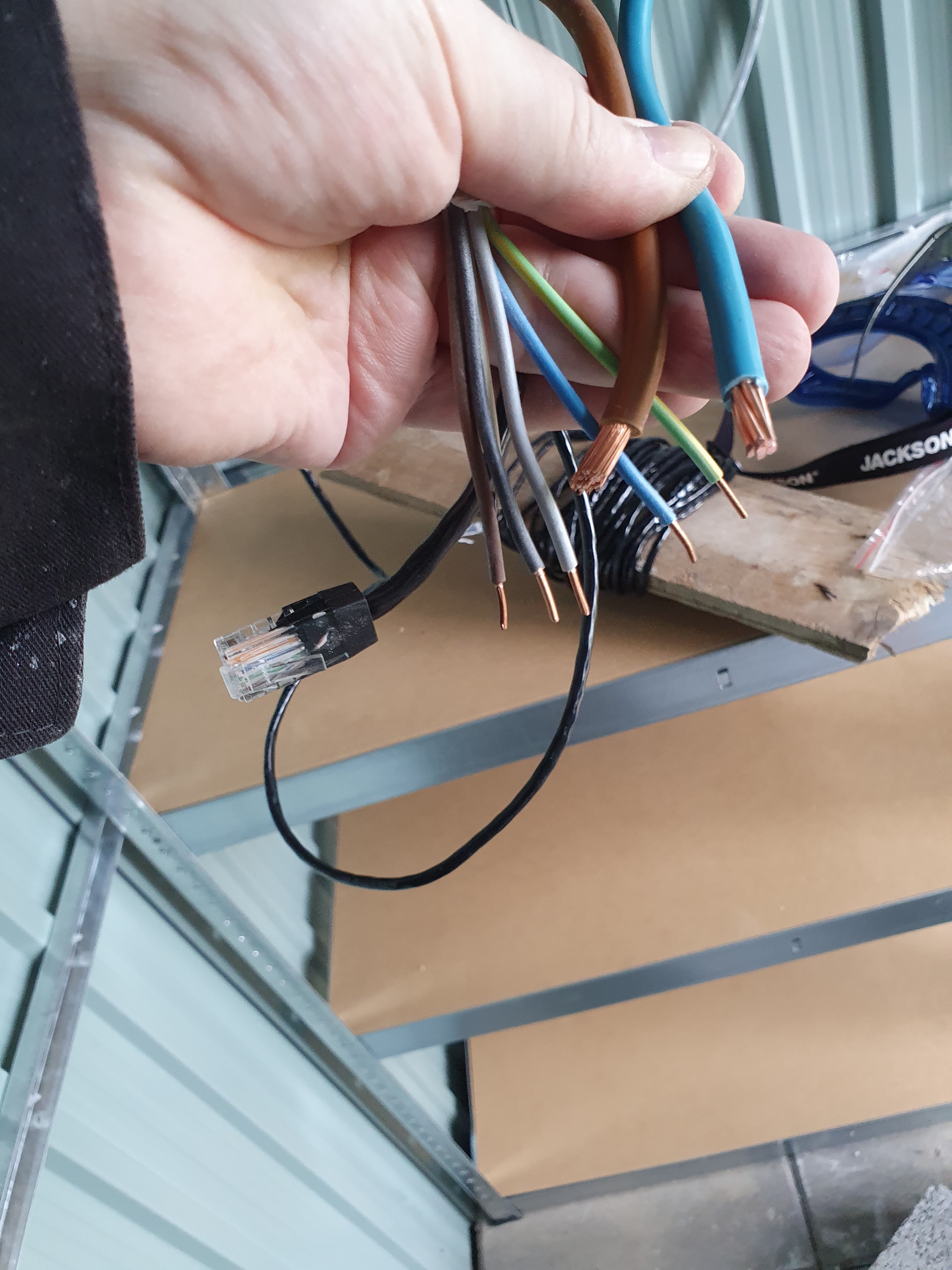

In terms of progress on the site, I put in conduit and wiring for the garden shed: it now has ethernet, 1.5 mm2 three phase AC, and 16 mm2 DC main connections:

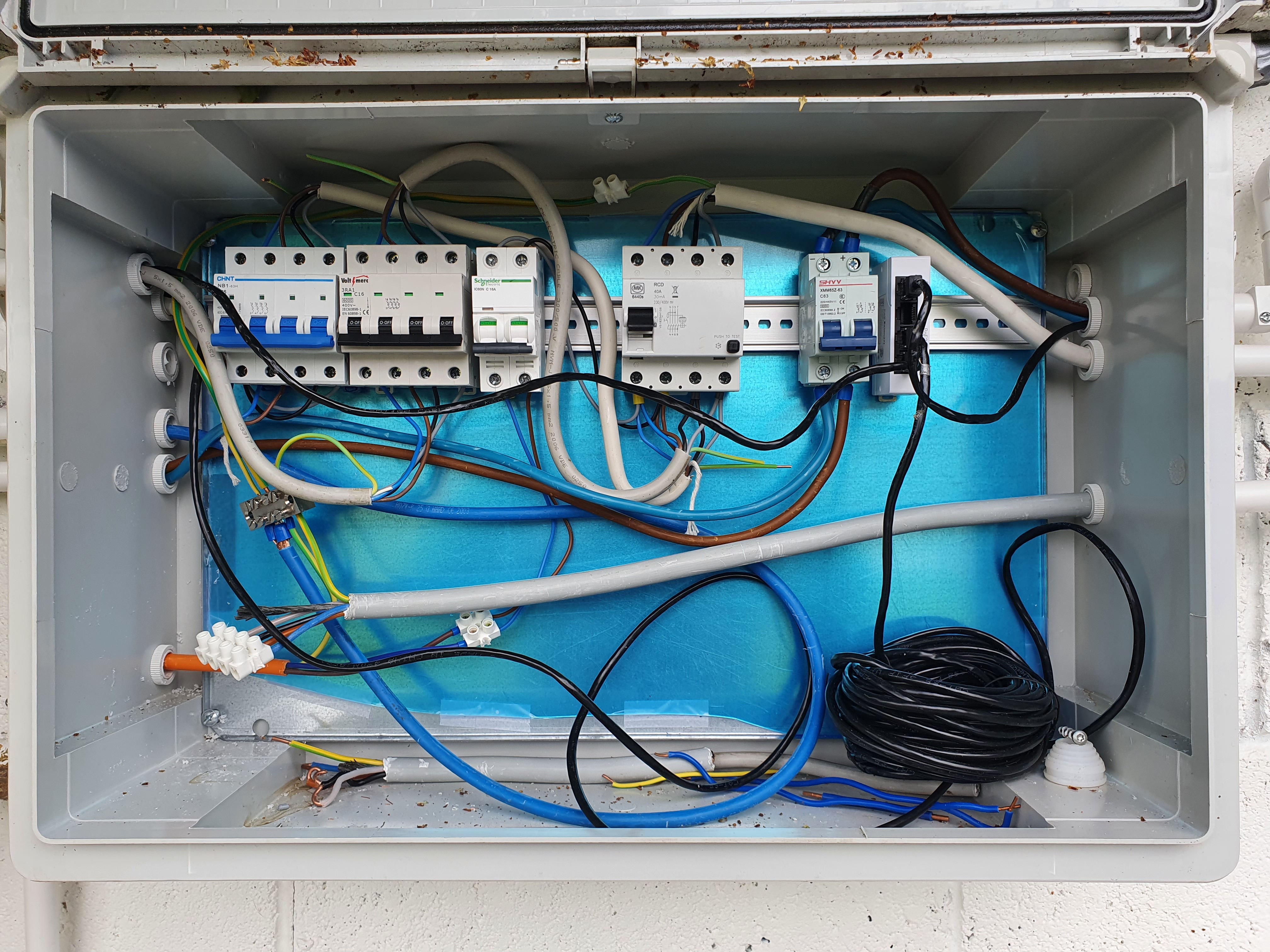

I almost completed the middle services box, only item missing is a 100v DC surge protector to protect the DC mains from getting shorted against an AC mains:

When I say ‘almost completed’, I mean before the build begins. Off the bottom of that box will drop a number of conduits taking electricity and internet to the house. They’ll be fitted later of course, and I only learned today during the M&E design meeting that building regs require that 10 mm2 mains cable (entering mid-right, currently unconnected except to earth) to be 16 mm2 even though my domestic mains connection couldn’t supply so much power. It’s not the end of the world, I’d actually fitted 16 mm2 up to the inverter which isn’t too far from from the middle services box, so it’s only a hundred euro wasted.

Finally, I got started on wiring up the far and near camera and flood light poles, here is me testing flood light placement:

The shipping container and temporary site office block most of the light unfortunately, however unlike them this pole is expected to be permanent and once they’re gone, that light should flood my front driveway most effectively.

In terms of everything else in getting this build going, I went to see a builder’s factory to see how the timber frames get made. Not a lot is different from the 16th century apart from the wood used and a very mild amount of automation – a human hand designs and draws the frame plans to match the architect’s plans. A Polish fellow manually chops up German sourced spruce wood and nails them into panels, cuts out the insulation to fit and staples it into the panel. The watertight membrane is then stapled in, and that’s your panel. When I say ‘Polish fellow’, I mean a specific one – there is only one person making panels for that builder, he does it all day long and that’s all he does there. Tedious work if you ask me, nice fellow though, friendly. And it’s certainly an honest day’s work.

Anyway, after he’s made all the panels, they get assembled onsite on a concrete base and within a week they’re done. You just need the glazing people to turn up quickly enough to get the glazing in before rain gets the panels too damp, after that it’s fairly weatherproof. I did ask about more automation, apparently the machines cost €80k each and if that builder did more than seventeen to eighteen houses per year, a machine might have payback before he would retire. But at his rate of house building, the numbers don’t add up, so you get this 16th century type of manual construction of everything. At least you get the human touch I suppose!

Regarding financing, the AIB have dramatically increased the amount of cash I need to raise before they will give me a mortgage. I no longer think I can raise it this year, so I am actively considering bridge financing instead. There are two options here, one is something like https://www.bridgingloans.ie/ where they will lend up to 65% LTV for around twelve months at a fairly eye watering interest rate, typically between 8% and 14% APR. The idea would be that you use that loan to complete the build, then take out a conventional mortgage at a much lower interest rate to repay the bridge loan.

The second option is that I take a Director’s loan from my company ned Productions Ltd for 75% of my normal gross income before tax, and pay myself almost nothing in salary that year. This effectively shifts the tax from one tax year to another, letting me borrow the tax I would normally pay to Revenue in a tax year (the other 25% is required as a refundable security by Revenue for the loan). The following year having completed the build, a conventional mortgage is used to repay the Director’s loan with interest. The company then makes twice its usual income, so I would be paid that tax year’s salary as well as the salary for the year preceding combined, which as a double salary would pay double the tax so Revenue get what tax they would have gotten with a bit of cream on top. This is fully legal, it just requires paperwork to be filed. Obviously, this isn’t as effective as a bridging loan – I normally pay around 50% of gross income in tax, so this approach can only yield 25% of gross income in additional financing. It is however much cheaper, as the interest paid at 4% half of it would come back to me salary later, making this form of financing have a total cost of maybe 3% during the loan’s duration as higher income means higher marginal rate of tax.

Cheapest of all of course remains the mortgage thanks to the €30k Help to Buy subsidy, which I lose if I don’t get a self build mortgage. So I’ll keep pursuing that option for now, though it’s looking increasingly unhopeful.

| Go to previous entry | Go to next entry | Go back to the archive index | Go back to the latest entries |